I don't know about you, but I haven't been able to memorize all the candlestick formations. If you want to become a serious student of candlesticks, reference the works of Steve Nison; he's the expert.

In the meantime, this page lists some of the more common pattern formations for your reference. If you want a TradeStation or MultiCharts indicator that labels the patterns, check out my Order Form.

| Abandoned Baby | A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day. |  |

| Dark Cloud Cover | A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high then closes below the midpoint of the body of the first day. |  |

| Doji | Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can vary, and the resulting candlestick looks like, either, a cross, inverted cross, or plus sign. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level. |  |

| Downside Tasuki Gap | A continuation pattern with a long, black body followed by another black body that has gapped below the first one. The third day is white and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap. |  |

| Dragonfly Doji | A Doji where the open and close price are at the high of the day. Like other Doji days, this one normally appears at market turning points. |  |

| Engulfing Pattern (Bullish or Bearish) | A reversal pattern that can be bearish or bullish, depending upon whether it appears at the end of an uptrend (bearish engulfing pattern) or a downtrend (bullish engulfing pattern). The first day is characterized by a small body, followed by a day whose body completely engulfs the previous day's body. |

|

| Evening Doji Star | A three day bearish reversal pattern similar to the Evening Star. The uptrend continues with a large white body. The next day opens higher, trades in a small range, then closes at its open (Doji). The next day closes below the midpoint of the body of the first day. |  |

| Evening Star | A bearish reversal pattern that continues an uptrend with a long white body day followed by a gapped up small body day, then a down close with the close below the midpoint of the first day. |  |

| Falling Three Methods | A bearish continuation pattern. A long black body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new low. |  |

| Gravestone Doji | A doji line that develops when the Doji is at, or very near, the low of the day. |  |

| Hammer | Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during an advance, then it is called a Hanging Man. |  |

| Hanging Man | Hanging Man candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during a decline, then it is called a Hammer. |  |

| Harami | A two day pattern that has a small body day completely contained within the range of the previous body, and is the opposite color. |  |

| Harami Cross | A two day pattern similar to the Harami. The difference is that the last day is a Doji. |  |

| Inverted Hammer | A one day bullish reversal pattern. In a downtrend, the open is lower, then it trades higher, but closes near its open, therefore looking like an inverted lollipop. |  |

| Long Day | A long day represents a large price move from open to close, where the length of the candle body is long. |  |

| Long-Legged Doji | This candlestick has long upper and lower shadows with the Doji in the middle of the day's trading range, clearly reflecting the indecision of traders. |  |

| Long Shadows | Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the first part of the session bidding prices higher. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the first part of the session driving prices lower. |  |

| Marubozo | A candlestick with no shadow extending from the body at either the open, the close or at both. The name means close-cropped or close-cut in Japanese, though other interpretations refer to it as Bald or Shaven Head. |  |

| Morning Doji Star | A three day bullish reversal pattern that is very similar to the Morning Star. The first day is in a downtrend with a long black body. The next day opens lower with a Doji that has a small trading range. The last day closes above the midpoint of the first day. |  |

| Morning Star | A three day bullish reversal pattern consisting of three candlesticks - a long-bodied black candle extending the current downtrend, a short middle candle that gapped down on the open, and a long-bodied white candle that gapped up on the open and closed above the midpoint of the body of the first day. |  |

| Paper Umbrella | The Paper Umbrella appears when a small body comes with a long lower shadow. The Paper Umbrella is a strong reversal sign. |  |

| Piercing Line | A bullish two day reversal pattern. The first day, in a downtrend, is a long black day. The next day opens at a new low, then closes above the midpoint of the body of the first day. |  |

| Rising Three Methods | A bullish continuation pattern in which a long white body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new high. |  |

| Shooting Star | A single day pattern that can appear in an uptrend. It opens higher, trades much higher, then closes near its open. It looks just like the Inverted Hammer except that it is bearish. |  |

| Short Day | A short day represents a small price move from open to close, where the length of the candle body is short. | |

| Spinning Top | Candlestick lines that have small bodies with upper and lower shadows that exceed the length of the body. Spinning tops signal indecision. |  |

| Stars & Raindrops | A Star appears when a small body gaps ABOVE the previous day's long

body. Stars are part of more complicated candlestick patterns, especially

the reversal patterns.

A Rain Drop appears when a small body gaps BELOW the previous day's long body. Rain Drops are part of the more complicated patterns, especially the reversal patterns. |

|

| Stick Sandwich | A bullish reversal pattern with two black bodies surrounding a white body. The closing prices of the two black bodies must be equal. A support prices is apparent and the opportunity for prices to reverse is quite good. |  |

| Three Black Crows | A bearish reversal pattern consisting of three consecutive long black bodies where each day closes at or near its low and opens within the body of the previous day. |  |

| Three White Soldiers | A bullish reversal pattern consisting of three consecutive long white bodies. Each should open within the previous body and the close should be near the high of the day. |  |

| Upside Gap Two Crows | A three day bearish pattern that only happens in an uptrend. The first day is a long white body followed by a gapped open with the small black body remaining gapped above the first day. The third day is also a black day whose body is larger than the second day and engulfs it. The close of the last day is still above the first long white day. |  |

| Upside Tasuki Gap | A continuation pattern with a long white body followed by another white body that has gapped above the first one. The third day is black and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap. |  |

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don't spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don't spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.

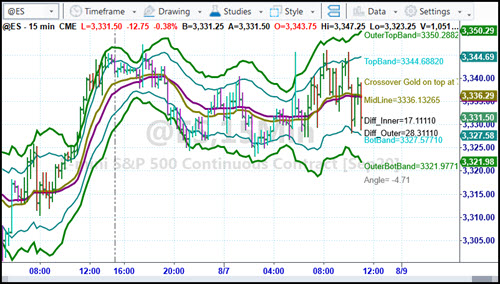

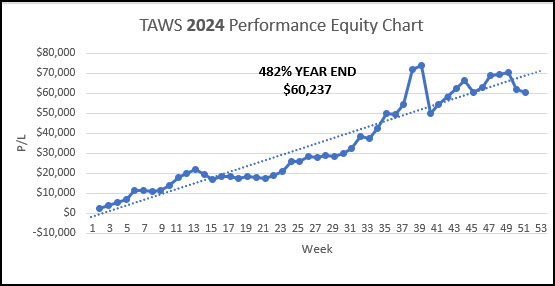

NOW AVAILABLE: Live Trading with Sunny EVERY MORNING. (Trade Along with Sunny - TAWS) Want to see and hear how Sunny trades with SunnyBands? Listen to her reasoning and watch as she places trades. Here's your chance. Subscribe Here.

PERFORMANCE 2024 Year-End:

PERFORMANCE 2025 To Date

"Hi Sunny, wanted to share with you my profits for the day and say thank you! $19,412.50." -S. S., Mission Viejo, CA

"I wanted to let you know how helpful your daily trading room sessions have been. It is refreshing to see someone trade live and answer any questions that we have. It is so much better than a service that just wants to sell you something and send you on your way. This is really speeding up my learning and I look forward to trading along with you. Thanks for all you are doing to help people learn the art of trading." - Rick N.

"I had the fortune of meeting Sunny Harris and her excellent trade software SunnyBands. From the beginning, she gave me all her support, even though I didn't have any experience with day trade and English is not my first language she is always available for any questions. I tested SunnyBands free trial and the results were amazing $3.5K in the first week, I asked for another free trial and she was able to help me, I did it again, and after these records, I decided to buy the license for Sunny Bands. Thank Sunny for your unconditional support and your excellent software." -Juan R.

"I have studied swing and day trading for 10 years primarily with Gann methodology but I might be able to say I have studied it all. I lead a monk's life studying 12 hrs a day. I have found SunnyBands correlate to the high work of mathematics in price and one tool I treasure now for my chart analysis and trading. The first day I loaded SunnyBands I made $275 with one contract in about a minute; I thought to myself how can this small monthly fee not pay for itself? The opportunity to trade with such an experienced trader as Sunny is a real gift; the experience you will get in a year will be priceless. Doing this each trading day with Sunny will train your subconscious mind to become a consistent winner in the market. If you are thinking with a poverty mindset you will have a long hard road; don't do that. This is really awesome to be able to trade with each day and so appreciative of you doing this. To live trade as a mentor like you do is very hard and much respect and appreciation for you doing this Sunny!" - Arthur M.

"Well, I just want to say the I LOVE them !!!! ( your bands )....I've torn apart Bollinger Bands, Keltner etc, etc... and NOTHING comes CLOSE to what YOU have created.... :-) I've talked to CMT's who've said "oh yeah.... they're just Bollies".....and I almost spit out my coffee! I've watched your videos where you are walking a new customer through their use... and I "got it all" ( understood )... the "turns" are RIGHT THERE!.... Bollies are too general....and Keltner which Rashke says she likes....are only a hair better than Bollies.... YOURS blows both of them away.....of course YOU already know that." - Marius V.

The Podcasts of John Bolllinger, Steve Nison, Gene Inger, Hima Reddy, Brad Matheny, William Eng, Louis Navellier, Cynthia Kase, Howard Getson, Jake Bernstein, Arch Crawford, Henry Weingarten, Robert Pardo, Sherman & Tom McClellan, Stan Ehrlich, Steven Primo, Carolyn Boroden, Markus Heitkoetter, Dan Passarelli, Ted Hearne, Larry Pesavento, Norm Winski, Greg Morris, Larry Williams, Linda Bradford Raschke, Anka Metcalf and Robert Colby are now posted. Enjoy these great interviews. And after that whom would you like to see next?

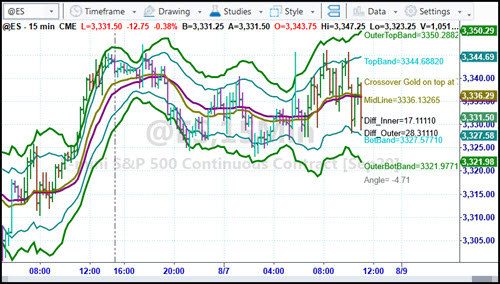

You've had plenty of opportunites to watch how Sunny trades. There's the Live Trading Room, lots of Appearances, YouTube videos and Live Demos. If you have not yet been introduced to SunnyBands and how Sunny uses them, sign up here to get the Replay of the event.

WHAT ARE YOU MISSING?

Several features of Sunny Side of the Street are missing from previous issues. Natural Numbers, Scan of Stocks, DMA_H RS, PHW Scan, and more. What would you like to see me bring back? Comments.

HAPPY HALF HOUR! We will have the next HHH on Saturday January 4th at 1:15pm PT.Sam Tennis and I will be hosting the Next Free Networking Event for all Traders new and old to join in the discussion and "get to know each other" event. It's a great place to make new friends. Sign Up Here. This Free meeting of like minds will be held once a month, on the 4th of each month. We all have a great time and share liberally on the 4th of evey month. It's a lot of fun! Don't miss it next time. Click HERE to join us. You must be registered to get the invitation and link.

Free Live Demo Replay available Here.

If you would like to continue receiving this weekly newsletter every week, please SUBSCRIBE. It helps the cause.

FREE 7-Day Trial of Sunny's Most Powerful Indicators. Click Here. You have 7 (calendar) days to use it' full functionality and learn! I can only take 20 trials per month and all start on a Monday. Get your request in early.

EasyLanguage Forum Want to learn EasyLanguage (EZL) the EASY way? Here is the REPLAY (with video and slides). 5 1-hr lessons will take you through all the steps with Sunny Harris and Sam Tennis.

FREE 7-day Trial of Sunny's most Powerful trading indicators. Not sure about buying them? Take the trial. Most make enough during the Free Trial to cover the investment.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

Go to www.easylanguageooel.com, register as a Free Member and I'll send your FREE indicators wi th your proof of purchase